ALTRES Inc. CEO, Barron Guss provides a behind the scenes understanding of Hawaii’s Unemployment Trust Fund crisis for Hawaii Businesses and what’s in store for the road ahead.

0:00 – “UI Background – How we got here”

8:36 – “Unpacking the Legislative Solutions”

17:56 – “UTF Solutions – The Elephant in the Room”

Update – Gov Ige Signs HB 1278 (3/3/21)

After months of collaboration between ALTRES’ CEO, Barron Guss, the DLIR, key legislators, and business leaders, Governor Ige signed HB 1278 HD1 Relating to Employment Security into law on Tuesday, March 2nd. The Bill provides economic relief to all employers across the State. Prior to today’s signing, employers were mandated to contribute to the State Unemployment Insurance fund using Schedule H, which is approximately 50% higher than the newly implemented Schedule D.

Update – UI Relief Bill sent to Governor (2/24/21)

On Wednesday, the legislature held a press conference regarding House Bill 1278 HD1 which won final passage on Monday and was sent to the Governor’s desk for signing this afternoon.

HB 1278 HD1 seeks to expedite the State’s economic recovery by temporarily reducing the employer’s unemployment contribution rates to Schedule “D” for 2021 and 2022.

To watch the press conference, click below.

The pandemic has had far-reaching effects on all aspects of everyday life and Hawaii businesses are no exception and have experienced more than their fair share of hardship beyond the forced closures. Now, they face a new threat that could have them shutting their doors forever.

Since March, the State of Hawaii Unemployment Trust Fund (UTF) has been paying out benefits to a substantial portion of Hawaii residents at unprecedented rates. Unfortunately, the system could not sustain an outpouring of money at these levels and now the fund has reached a point of insolvency and employers are mandated to replenish it.

Over the past 40 years working in the Professional Employer industry on both the local and national level, I have witnessed the financial breakdown of other UI funds but never on this magnitude or with such unimaginable consequences for Hawaii.

In the News

Most likely you have seen that this issue has made the news, but little has been reported on what is really being done to address the problem or what the solution might be. The reason for this lack of reporting is that this is a very complex issue, and the potential solutions will have a lot of moving parts. I will do my best to break it down for you without writing a dissertation on the subject.

The Problem – If you dislike minutia, you can skip to the “Solution(s)” section below

With the pandemic and resulting work furloughs, the only source of emergency welfare for Hawaii workers was, and continues to be, the State of Hawaii UI system. When reading this statement, many will recall the PPP loans, but keep in mind that those funds basically only provided financial assistance for an eight-week period and, come March 1st, the pandemic will have been with us for 52 weeks (one year). Outside of a few discreet financial assistance programs, the UI system is the ONLY program in place to provide emergency economic assistance.

It’s important to keep in mind that the SUI system was NOT designed to provide community-wide economic assistance in the event of an emergency or, in this case, a pandemic. It is intended to act as a relief mechanism for the gradual expansion and contraction of an economy. It specifically addresses the temporary needs of individuals when they find themselves without income and can also temper the effects of an economic downturn.

Recessions come on gradually and, by design, the State Unemployment Tax Act (SUTA) fund can self-regulate and manage an unemployed population of 2.4%, similar to what we experienced in 2019 and even a number close to twice that of 4.5%, as we had in 2010.

In April and May of 2020, the two-month average for the unemployed in the islands reached 24.0% with November’s average at 10.1%.

With these unprecedented unemployment levels it’s easy to understand why the reserves in a system, that was not designed for emergency welfare, would collapse under its own weight with a tenfold increase in benefits paid out in only two months. Even at today’s averages, the system is being taxed at a 4X ratio.

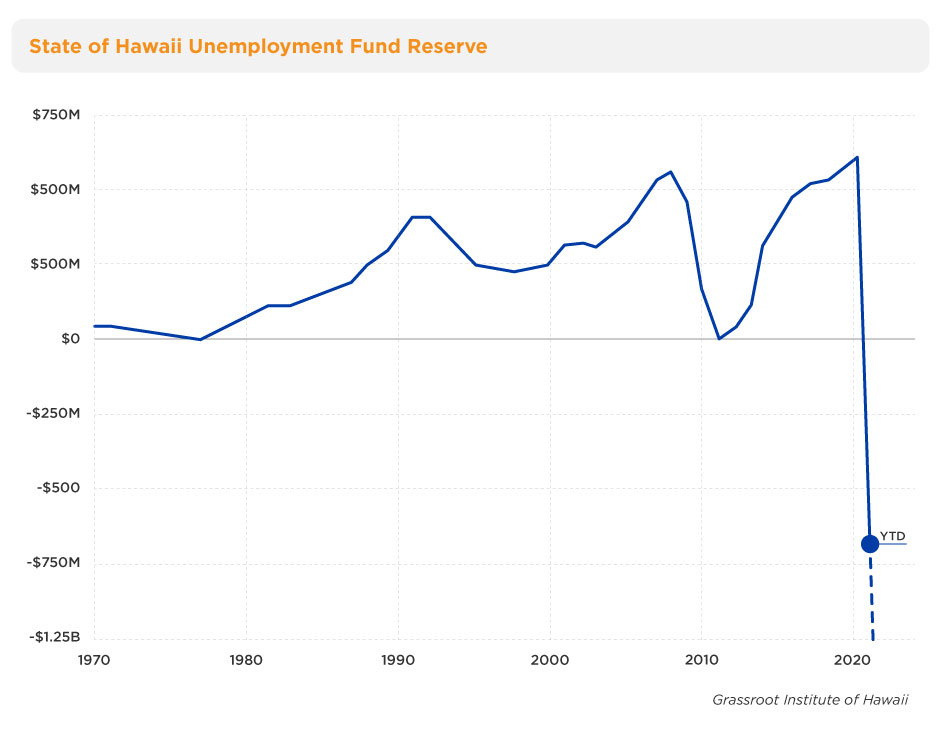

In 2019, the State received approximately $178M in contributions via unemployment taxes on wages by employers. In contrast, it paid out $151M in benefits to qualifying individuals, leaving a year-end surplus of over $25M and an accumulated $600M in reserves.

How the System is Funded

The Unemployment Trust Fund (UTF) is funded through taxes levied on the wages employers pay their employees via a “rate schedule,” and within that schedule are ranges that take into account an employer’s individual experience. An employer can fall at the low or high range of the schedule based on the balance and withdrawals made on their allocated account. Without going too deep here, you can assume that an employer with high turnover would most likely have a higher rate within the schedule because of the number of employees who have lost their jobs and seek benefits, in contrast to an employer who has maintained the same workers within their workforce for 20 years with no turnover. You may be surprised to know that based on the 2019 and 2020 schedule “C” there were over 5,000 employers who paid no tax (0.00%) on the wages paid to employees because of individual experience.

The REAL Problem – At the end 2021 Hawaii will owe the Federal Government $1.242B!

As of July 2020, the ten-year accumulated reserves of $600M in the UI Fund was depleted to zero. Because of Hawaii’s participation in the Federal Unemployment program, it is entitled to borrow money (Title XII Advances) in the event of a deficit such as we have today. As of December 2020, the State of Hawaii had borrowed $749M from the federal government and since then it has paid down the balance from two sources – leftover CARES Act funds from the first round of funding and approximately $3M from employer contributions. I will spare you the details, but today’s loan balance is approximately $700M.

The most recent estimates are that Hawaii will pay out on average $60M a month or $720M in benefits over 2021, in contrast to the $151M of benefits paid out in 2019. Basically, when you factor in the reduced contributions due to the pandemic and the borrowed balance of what is needed to provide benefits, by the end 2021 Hawaii will owe the Federal Government $1.242B!

Loan Repayment

Like all loans, there are repayment terms that involve principal and interest. In the case of the Title XII Advances, they are interest free for an initial period as long at the balance is paid in full by a certain date. In the case of the current $700M loan, Hawaii has until November 10, 2022 to pay off the balance or face an interest charge of 2.77%. But that’s not all.

Most employers perceive that the FUTA (Federal Unemployment Tax Act) rate is .60% on the first $7000 of wages or $42.00 per employee per year. But in fact, the rate is 6.0% or $420. Because of Hawaii’s participation in the federal program, employers in the state are entitled to a FUTA tax reduction/credit of 5.4%, which yields the .60% rate that we are accustomed to paying.

The “hammer” that the fed uses to incent timely repayment is not only interest charges, but a decrease in the FUTA credit. To illustrate, if Hawaii misses the November 10, 2022 payment deadline, beginning in 2023, Hawaii employers will pay .90% on the first $7000 each employee’s wage or $56.00. The reduction in the FUTA credit will continue and decrease (increase taxes) year after year until the loan is repaid. There are some additional requirements and penalties that can be tacked on after the third year of non-repayment that, coupled with the nonpayment penalty, could have Hawaii employers losing their 5.4 exemption FUTA credit within the next ten years.

The Solution(s) – There appear to be many

It is going to take legislative action to get the relief that employers are looking for. After a good amount of exhaustive efforts by all invested parties, there are several bills that are being introduced.

If you have ever been involved in the legislative process, you will have witnessed that sometimes things go on that make no sense to those of us on the “outside.” I say this because there are three bills that achieve basically the same thing – immediate relief for employers to assist with the restart of the economy. The difference between each of them is the way they address the repayment of the Title XII Advances (loans) with each approach having different long-term effects.

The first bill S.B.1159 is from the administration and has been introduced as part of the Governor’s legislative package, and the others are from both the Senate and House leadership.

Where the politics come in is that SUTA tax relief is supported from all parties, including the Governor and both the House and the Senate, one of the three bills will eventually take the lead and the others will die – it’s just that everyone wants to claim that their bill was “the one that saved the economy.”

I will try to highlight the essential parts of each bill below. Keep in mind that for 2020, the DOL used Schedule “C” to fund the UTF and, because of the insolvency, the DOL was mandated to move the schedule to “H” which is a 217% increase or three times the current average rate paid by employers. To put this into perspective, the average contribution made by employers for each employee in 2021, using schedule “C”, would be $568.80. As the statute is written, the average contribution rises to $1801.20 or a $1232.40 increase. Given this, it is easy to see why legislative relief is imperative.

Administration – S.B 1159

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “F” 62.5% increase over “D” $474.00 or an annual contribution of $1232.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2023 Schedule “G” 23.1% increase over “F” $284.40 or an annual contribution of $1516.80

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]In the administration’s bill, the claims experience for 2020 and 2021 will not be used and, for all intents and purposes, any claim made due to COVID-19 will not be expensed towards the employer’s account. This should help keep employer’s individual rates within the schedule stabilized for 2021 and 2022. There is no mention of 2023 and beyond. The DOL’s approach is to start to rebuild the solvency of the UTF and, although they will still borrow more funds in 2021 and possibly more in 2022, they would like to keep up with the interest payments using cash-flow from the employer contributions.

House Bill – H.B. 1278

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “C” 0% increase over 2020 or an annual contribution of $568.60

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]In the House bill, their immediate concern is to restart the economy. To that end, their bill will not impose any immediate financial burden on employers. There is a belief that the repayment of the federal loans should be dealt with later and possibly paid back from the general fund or a bond issuance. For now, they want to get our economy rebounding.

Other Senate Bill – S.B. 682

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “C” 0% increase over 2020 or an annual contribution of $568.60

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2023 Schedule “E” 25% increase over “D” $189.60 or an annual contribution of $948.00

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]The difference between S.B. 682 and the above House bill is that S.B. 682 adds an additional year’s schedule increase for 2023 and also omits the individual claims experience for 2021 and 2022.

The Outlook

I have been working with all concerned parties including the DLIR, the Governor’s office, key legislators, and business leaders, and there is consensus by all that something needs to be done. I believe that, barring some political posturing (which can always happen), we will end up with a hybrid of the three bills and the much-needed relief from Schedule “H,” if not, we will bury Hawaii’s economic future for generations to come.

You Can Make a Difference

The hearings have begun and it’s not too late for your voice to be heard. First, you can write a letter to your delegate or you can submit testimony in person via “Zoom” by clicking here. Let them know that you want them to pass legislation to help you keep your business open and preserve jobs.

I hope this primer was informative and will provide you with a little comfort from this potentially untenable situation.

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”20″ margin_bottom=”20″]About Barron Guss

A recognized leader of the national Professional Employer Organization (PEO) industry and long-time board member and 2019 chairman of the National Association of Professional Employer Organizations (NAPEO), his company began providing Human Resource services to local employers in 1969 when the industry was still in its infancy. Barron continues to lead the charge in the Business Administration arena and his dedication to innovation earned him the 2021 Corporate Intrapreneur of the Year by Hawaii Venture Capital Association.

Sign up for our newsletter

Sign up for our monthly HIVE newsletter and get tips for finding a job, managing a business and advancing your career right in your inbox.

ALTRES Inc. CEO, Barron Guss provides a behind the scenes understanding of Hawaii’s Unemployment Trust Fund crisis for Hawaii Businesses and what’s in store for the road ahead.

0:00 – “UI Background – How we got here”

8:36 – “Unpacking the Legislative Solutions”

17:56 – “UTF Solutions – The Elephant in the Room”

Update – Gov Ige Signs HB 1278 (3/3/21)

After months of collaboration between ALTRES’ CEO, Barron Guss, the DLIR, key legislators, and business leaders, Governor Ige signed HB 1278 HD1 Relating to Employment Security into law on Tuesday, March 2nd. The Bill provides economic relief to all employers across the State. Prior to today’s signing, employers were mandated to contribute to the State Unemployment Insurance fund using Schedule H, which is approximately 50% higher than the newly implemented Schedule D.

Update – UI Relief Bill sent to Governor (2/24/21)

On Wednesday, the legislature held a press conference regarding House Bill 1278 HD1 which won final passage on Monday and was sent to the Governor’s desk for signing this afternoon.

HB 1278 HD1 seeks to expedite the State’s economic recovery by temporarily reducing the employer’s unemployment contribution rates to Schedule “D” for 2021 and 2022.

To watch the press conference, click below.

The pandemic has had far-reaching effects on all aspects of everyday life and Hawaii businesses are no exception and have experienced more than their fair share of hardship beyond the forced closures. Now, they face a new threat that could have them shutting their doors forever.

Since March, the State of Hawaii Unemployment Trust Fund (UTF) has been paying out benefits to a substantial portion of Hawaii residents at unprecedented rates. Unfortunately, the system could not sustain an outpouring of money at these levels and now the fund has reached a point of insolvency and employers are mandated to replenish it.

Over the past 40 years working in the Professional Employer industry on both the local and national level, I have witnessed the financial breakdown of other UI funds but never on this magnitude or with such unimaginable consequences for Hawaii.

In the News

Most likely you have seen that this issue has made the news, but little has been reported on what is really being done to address the problem or what the solution might be. The reason for this lack of reporting is that this is a very complex issue, and the potential solutions will have a lot of moving parts. I will do my best to break it down for you without writing a dissertation on the subject.

The Problem – If you dislike minutia, you can skip to the “Solution(s)” section below

With the pandemic and resulting work furloughs, the only source of emergency welfare for Hawaii workers was, and continues to be, the State of Hawaii UI system. When reading this statement, many will recall the PPP loans, but keep in mind that those funds basically only provided financial assistance for an eight-week period and, come March 1st, the pandemic will have been with us for 52 weeks (one year). Outside of a few discreet financial assistance programs, the UI system is the ONLY program in place to provide emergency economic assistance.

It’s important to keep in mind that the SUI system was NOT designed to provide community-wide economic assistance in the event of an emergency or, in this case, a pandemic. It is intended to act as a relief mechanism for the gradual expansion and contraction of an economy. It specifically addresses the temporary needs of individuals when they find themselves without income and can also temper the effects of an economic downturn.

Recessions come on gradually and, by design, the State Unemployment Tax Act (SUTA) fund can self-regulate and manage an unemployed population of 2.4%, similar to what we experienced in 2019 and even a number close to twice that of 4.5%, as we had in 2010.

In April and May of 2020, the two-month average for the unemployed in the islands reached 24.0% with November’s average at 10.1%.

With these unprecedented unemployment levels it’s easy to understand why the reserves in a system, that was not designed for emergency welfare, would collapse under its own weight with a tenfold increase in benefits paid out in only two months. Even at today’s averages, the system is being taxed at a 4X ratio.

In 2019, the State received approximately $178M in contributions via unemployment taxes on wages by employers. In contrast, it paid out $151M in benefits to qualifying individuals, leaving a year-end surplus of over $25M and an accumulated $600M in reserves.

How the System is Funded

The Unemployment Trust Fund (UTF) is funded through taxes levied on the wages employers pay their employees via a “rate schedule,” and within that schedule are ranges that take into account an employer’s individual experience. An employer can fall at the low or high range of the schedule based on the balance and withdrawals made on their allocated account. Without going too deep here, you can assume that an employer with high turnover would most likely have a higher rate within the schedule because of the number of employees who have lost their jobs and seek benefits, in contrast to an employer who has maintained the same workers within their workforce for 20 years with no turnover. You may be surprised to know that based on the 2019 and 2020 schedule “C” there were over 5,000 employers who paid no tax (0.00%) on the wages paid to employees because of individual experience.

The REAL Problem – At the end 2021 Hawaii will owe the Federal Government $1.242B!

As of July 2020, the ten-year accumulated reserves of $600M in the UI Fund was depleted to zero. Because of Hawaii’s participation in the Federal Unemployment program, it is entitled to borrow money (Title XII Advances) in the event of a deficit such as we have today. As of December 2020, the State of Hawaii had borrowed $749M from the federal government and since then it has paid down the balance from two sources – leftover CARES Act funds from the first round of funding and approximately $3M from employer contributions. I will spare you the details, but today’s loan balance is approximately $700M.

The most recent estimates are that Hawaii will pay out on average $60M a month or $720M in benefits over 2021, in contrast to the $151M of benefits paid out in 2019. Basically, when you factor in the reduced contributions due to the pandemic and the borrowed balance of what is needed to provide benefits, by the end 2021 Hawaii will owe the Federal Government $1.242B!

Loan Repayment

Like all loans, there are repayment terms that involve principal and interest. In the case of the Title XII Advances, they are interest free for an initial period as long at the balance is paid in full by a certain date. In the case of the current $700M loan, Hawaii has until November 10, 2022 to pay off the balance or face an interest charge of 2.77%. But that’s not all.

Most employers perceive that the FUTA (Federal Unemployment Tax Act) rate is .60% on the first $7000 of wages or $42.00 per employee per year. But in fact, the rate is 6.0% or $420. Because of Hawaii’s participation in the federal program, employers in the state are entitled to a FUTA tax reduction/credit of 5.4%, which yields the .60% rate that we are accustomed to paying.

The “hammer” that the fed uses to incent timely repayment is not only interest charges, but a decrease in the FUTA credit. To illustrate, if Hawaii misses the November 10, 2022 payment deadline, beginning in 2023, Hawaii employers will pay .90% on the first $7000 each employee’s wage or $56.00. The reduction in the FUTA credit will continue and decrease (increase taxes) year after year until the loan is repaid. There are some additional requirements and penalties that can be tacked on after the third year of non-repayment that, coupled with the nonpayment penalty, could have Hawaii employers losing their 5.4 exemption FUTA credit within the next ten years.

The Solution(s) – There appear to be many

It is going to take legislative action to get the relief that employers are looking for. After a good amount of exhaustive efforts by all invested parties, there are several bills that are being introduced.

If you have ever been involved in the legislative process, you will have witnessed that sometimes things go on that make no sense to those of us on the “outside.” I say this because there are three bills that achieve basically the same thing – immediate relief for employers to assist with the restart of the economy. The difference between each of them is the way they address the repayment of the Title XII Advances (loans) with each approach having different long-term effects.

The first bill S.B.1159 is from the administration and has been introduced as part of the Governor’s legislative package, and the others are from both the Senate and House leadership.

Where the politics come in is that SUTA tax relief is supported from all parties, including the Governor and both the House and the Senate, one of the three bills will eventually take the lead and the others will die – it’s just that everyone wants to claim that their bill was “the one that saved the economy.”

I will try to highlight the essential parts of each bill below. Keep in mind that for 2020, the DOL used Schedule “C” to fund the UTF and, because of the insolvency, the DOL was mandated to move the schedule to “H” which is a 217% increase or three times the current average rate paid by employers. To put this into perspective, the average contribution made by employers for each employee in 2021, using schedule “C”, would be $568.80. As the statute is written, the average contribution rises to $1801.20 or a $1232.40 increase. Given this, it is easy to see why legislative relief is imperative.

Administration – S.B 1159

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “F” 62.5% increase over “D” $474.00 or an annual contribution of $1232.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2023 Schedule “G” 23.1% increase over “F” $284.40 or an annual contribution of $1516.80

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]In the administration’s bill, the claims experience for 2020 and 2021 will not be used and, for all intents and purposes, any claim made due to COVID-19 will not be expensed towards the employer’s account. This should help keep employer’s individual rates within the schedule stabilized for 2021 and 2022. There is no mention of 2023 and beyond. The DOL’s approach is to start to rebuild the solvency of the UTF and, although they will still borrow more funds in 2021 and possibly more in 2022, they would like to keep up with the interest payments using cash-flow from the employer contributions.

House Bill – H.B. 1278

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “C” 0% increase over 2020 or an annual contribution of $568.60

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]In the House bill, their immediate concern is to restart the economy. To that end, their bill will not impose any immediate financial burden on employers. There is a belief that the repayment of the federal loans should be dealt with later and possibly paid back from the general fund or a bond issuance. For now, they want to get our economy rebounding.

Other Senate Bill – S.B. 682

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2021 Schedule “C” 0% increase over 2020 or an annual contribution of $568.60

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2022 Schedule “D” 33% increase over “C” $189.60 or an annual contribution of $758.40

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]2023 Schedule “E” 25% increase over “D” $189.60 or an annual contribution of $948.00

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”5″ margin_bottom=”5″]The difference between S.B. 682 and the above House bill is that S.B. 682 adds an additional year’s schedule increase for 2023 and also omits the individual claims experience for 2021 and 2022.

The Outlook

I have been working with all concerned parties including the DLIR, the Governor’s office, key legislators, and business leaders, and there is consensus by all that something needs to be done. I believe that, barring some political posturing (which can always happen), we will end up with a hybrid of the three bills and the much-needed relief from Schedule “H,” if not, we will bury Hawaii’s economic future for generations to come.

You Can Make a Difference

The hearings have begun and it’s not too late for your voice to be heard. First, you can write a letter to your delegate or you can submit testimony in person via “Zoom” by clicking here. Let them know that you want them to pass legislation to help you keep your business open and preserve jobs.

I hope this primer was informative and will provide you with a little comfort from this potentially untenable situation.

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”20″ margin_bottom=”20″]About Barron Guss

A recognized leader of the national Professional Employer Organization (PEO) industry and long-time board member and 2019 chairman of the National Association of Professional Employer Organizations (NAPEO), his company began providing Human Resource services to local employers in 1969 when the industry was still in its infancy. Barron continues to lead the charge in the Business Administration arena and his dedication to innovation earned him the 2021 Corporate Intrapreneur of the Year by Hawaii Venture Capital Association.

Sign up for our newsletter

Sign up for our monthly HIVE newsletter and get tips for finding a job, managing a business and advancing your career right in your inbox.